Questions? Call us now at 215.979.8030

NOTE: Part one of our section on customer feedback contains two articles:

There was a time that businesses relied on anonymous, aggregated customer feedback as the sole input for their customer strategies. And that time is quickly fading away, along with once-common practices like writing checks to pay monthly bills and physically signing mortgage application documents.

Technology has created a new age. It has driven innovation in banking, and it has tranformed how businesses can ask for, and act on, customer feedback. Online surveys can capture feedback from customers in real-time and tie it to a specific event. Companies can act on that feedback to forge stronger connections with their customers—based upon individual customer reactions to elements of the customer experience.

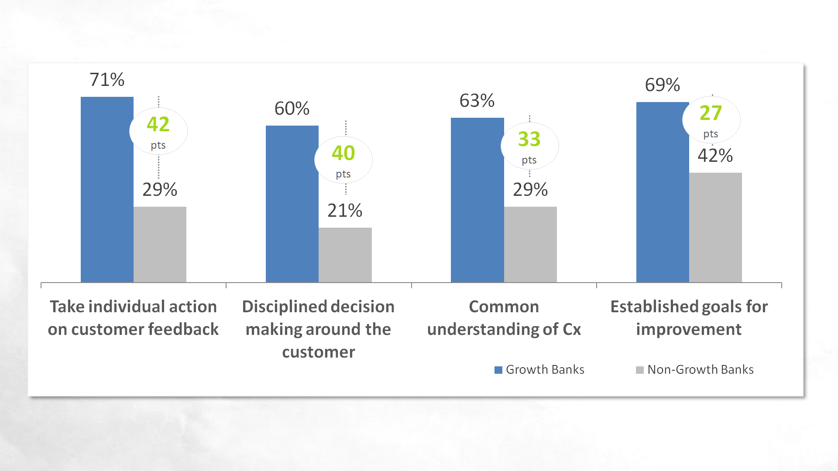

Taking individual action on customer feedback is the final discipline growth banks are adopting ahead of non-growth banks. In fact, it's the discipline with the greatest adoption gap between growth and non-growth banks. (42 points worth!)

For this reason, we're going to dig deeply into the various aspects of continuous, non-anonymous customer feedback programs. We'll also go over customer experience management solutions, including Voice of the Customer programs.

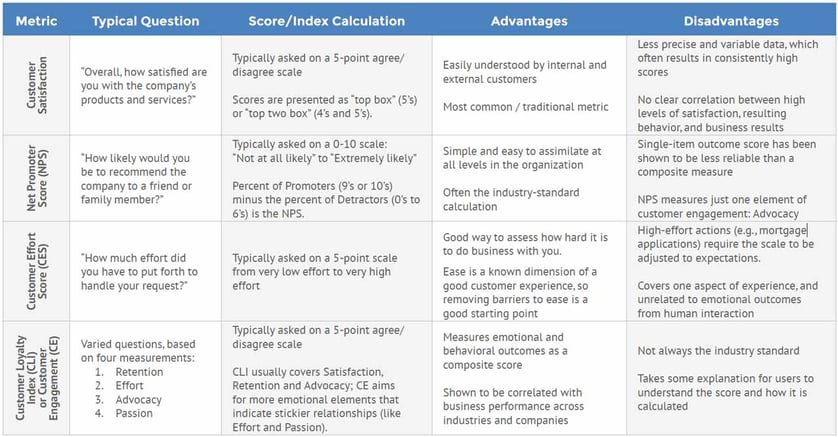

Let's begin with a discussion on the various outcome measures available for you to track.

An outcome measure is a question, or set of questions, that serves as an indicator of the strength of your experience. Simply put, if more customers are agreeing with your outcome measure, you'll know that your experience is improving—and your institution is also getting stronger.

The highest performing banks set clear goals for improvement around their outcome measures, as discussed in our previous section on goal setting.

Good question. There are a few characteristics of a good customer experience performance measure:

The measure correlates positively with business results. In choosing your outcome measure, you want to choose one that, if managed effectively, will lead to achievement of your stated goals. Does an increase in CSAT (i.e., customer satisfaction) lead to more referrals? Does a positive movement in your CLI (i.e., Customer Loyalty Index) lead to increased revenue?

The measure is used by others in your industry. It's easier to sell a metric to leadership if other high-performing institutions are using it. Adopting an industry standard means you can get agreement quickly, and it also makes it easy to benchmark your own bank against others.

The measure is easily understood internally. If your choice of metrics requires a 100-page manual or a three-credit course at a local university, then it's likely you've chosen the wrong one. A metric that everyone understands is a metric that everyone can act on.

The measure connects to your customer Wows and Woes. In developing customer understanding, you should gain a strong sense of what customers like and dislike about your customer experience. You can use that information to help you improve customer experience within your bank. By choosing a metric that not only correlates with bank performance, but also the foundation of your customer experience strategy, you can drive performance and improve customer experience.

You have a few. Check out this table, which summarizes four common metrics and provides a discussion of the advantages and disadvantages of each:

If you want to learn more about Voice of the Customer (VOC) and what to look for when considering launching your own VOC program, download our free eBook by clicking the image below.

If you’ve been keeping up with this series, you're familiar with the idea of gathering continuous customer feedback. But it's important to note the changing environment for how that feedback is handled.

Traditionally, customer satisfaction surveys have focused on collecting aggregate data. In the world of market research, this approach makes sense. It’s statistically accurate, high-level, and shows trending data—all great things for market researchers. But as customers have become more aware and their expectations have risen, this “open-loop” system falls short. Customers expect that if they take the time to provide personal feedback, then someone should take the time to provide personal follow-up.

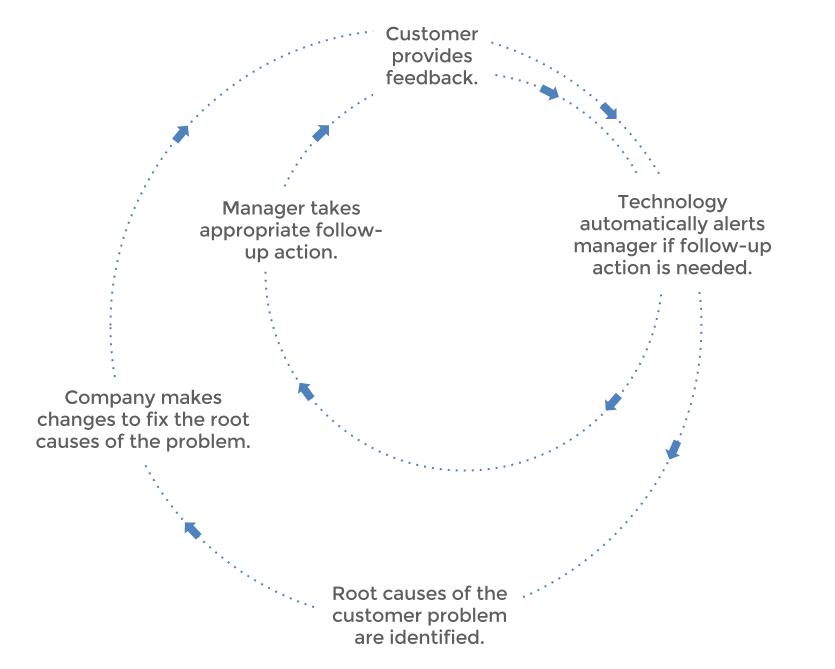

A closed-loop customer feedback management system gives institutions the tools they need to take this personal follow-up and “close the loop” on each piece of customer feedback. Ideally, your system should work on two different but complementary levels:

These qualities should be present in any effective customer feedback management solution as it relates to following up with individual customers:

Patricia Smith, President of Wealth Management at First Interstate Bank, explains the difference between our ongoing Voice of the Customer program and prior efforts the bank had undertaken to listen to customers:

"The biggest component in our relationship with PeopleMetrics is that the surveys aren’t anonymous, and it is a continuous improvement process—meaning we are able to attach the responses, then look at the customer relationships and better understand what’s working well and where our areas of opportunity lie.”

When you're trying to close the loop, you do not have to protect the identity of your customers who give you feedback. Two-way communication and dialogue is fundamental to a solid and healthy relationship with them.

Don't fall into the trap of asking your customers about all the elements of the experience that only matter to the bank’s leadership, managers and employees. Did our staff greet you by name? Did you have to wait in line longer than 2 minutes? Were you able to easily find our mobile banking app?

If you impose such questions, but they aren’t tied to issues or important to your customers, you can do little with the insights. Instead, structure an extremely short survey that elicits what’s important to the customer, what happened to them that warrants sharing, provides room to elaborate in their own words, and points bank employees to what they should do next.

The survey questions used in a closed-loop feedback program should clearly point to the best next action the bank should take.

It is possible now to trigger automatic notifications (e.g., email, SMS) to bank representatives that alert the employee to a piece of customer feedback requiring action.

These automatic notifications are a core element in a closed-loop customer feedback system. It helps branch managers hear from customers, quickly determine the context of feedback, and respond accordingly.

Common automatic notifications or Action Alerts include:

Many of our banking clients are also adopting Grow or Opportunity Alerts, which help employees identify opportunities for cross-selling and up-selling to their clients. This soft lead generation tool is helping to shift the culture at one of our client’s banks from one that is purely about service to one where sales, in the name of helping the customer, is an essential and acceptable part of the experience.

Asking managers to take action on real-time customer feedback requires work on their end. Strong closed-loop feedback programs provide tools to help managers delegate follow-up actions and track the progress of open cases. Case management tools make it easy to create transparency around the customer experience and ensure that no piece of feedback gets lost or overlooked.

As your managers or other employees close the loop with customers, they should document the root cause of the issue within the case management system. Perhaps customers are complaining about a lack of knowledge of staff at a given branch, and you know that branch has had high turnover and many new hires in recent months. Or perhaps numerous comments related to unexpected branch closings reveal a poor communications plan. By tracking root causes, you will be able to identify areas to improve your operations and eliminate the issues moving forward.

A closed-loop customer feedback program is a must-have for any bank looking to grow in this age of the customer. Learn more about the steps to follow by downloading our free closed-loop Voice of the Customer process map by clicking on the image below.

In the next email, we'll continue to look at how customer feedback can help you grow your bank and improve customer experience. As always, if you need us to clarify anything, or just want to chat, feel free to contact us. We'd be thrilled to hear from you.