Banks experiencing revenue growth are taking a disciplined approach to customer experience improvements. Results from our 2013 Most Engaging Customer Experiences (MECx) study show that many retail banks are taking on a broad array of customer experience activities:

- 75% Recognize employees for improving the customer experience

- 69% Share customer feedback with employees on a regular basis

- 51% Have a clearly defined set of target customers

* A full list of customer experience practices included in the study can be found in A Shifting Landscape: Customer Experience Trends and Priorities in Retail Banking

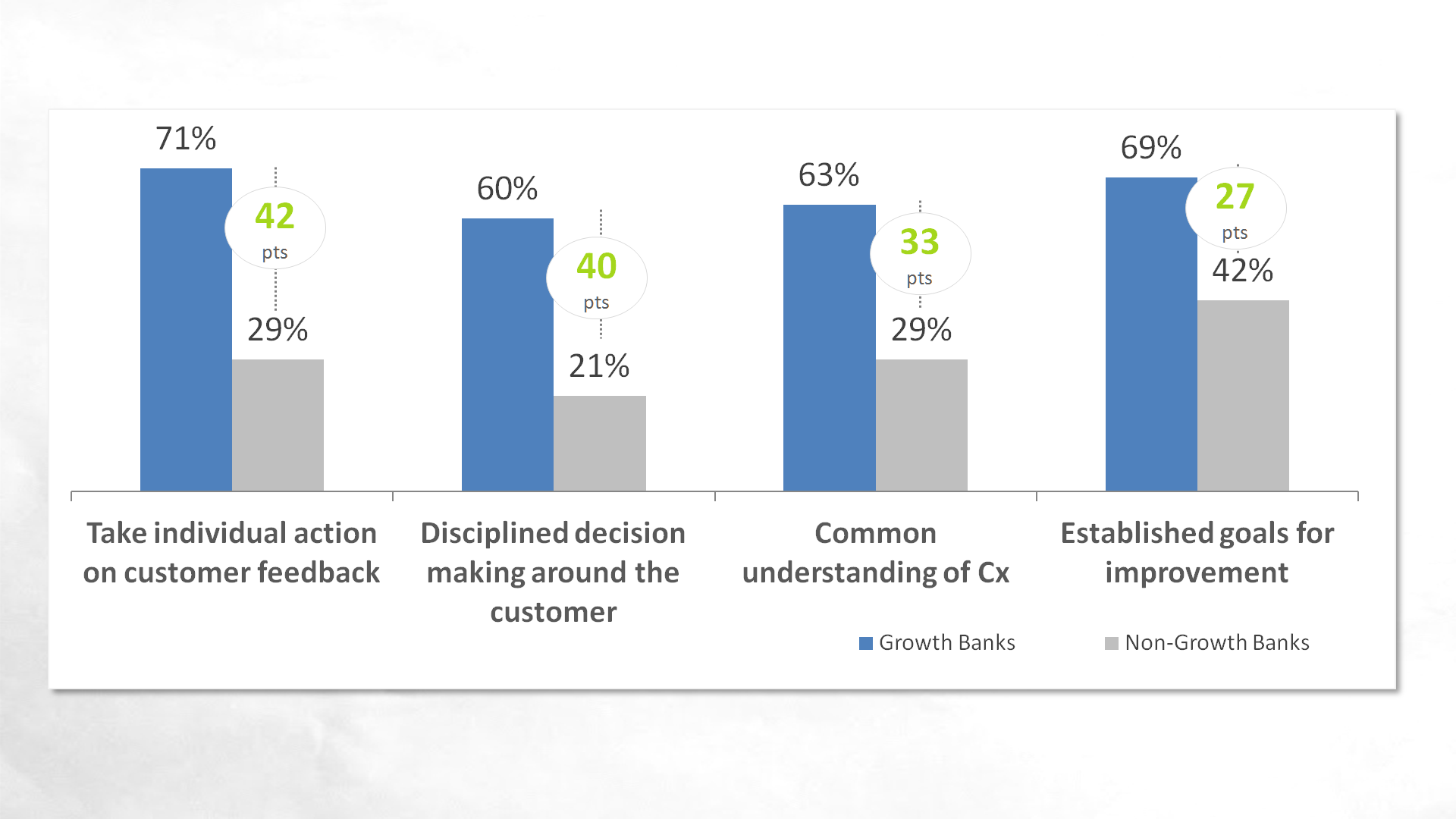

But these activities are not all created equal. Our analysis revealed that Growth Banks are better at four things in particular:

As a set, we see that Growth Banks are taking a disciplined approach to customer experience improvement:

- A common definition of what customer experience is and is not means everyone in the company understands why they are doing this work

- Clear goals for customer experience improvements means everyone in the company knows where they are going

- A decision-making process that emphasizes the customer means that everyone in the company knows how to make decisions around customer service, resource allocations, etc.

- Taking action on individual customer feedback means the right people in the company know what to do right now to improve the customer experience

For banks just getting started on the customer experience transformation journey, these practices offer guidance on where to focus for the biggest impact.

~Janessa Lantz

Interested in learning more?

If you'd like to learn more findings from our MECx study, then click here to download the research. If you're interested in learning more about customer experience in banking, then check out our free online course. It's email-based, and includes valuable articles and helpful, downloadable resources.