Introduction

In directing banks toward continued relevance and future success, banking executives face some tough, complex questions like:

- How do we avoid commoditization?

- How do we differentiate in a low-growth, low-margin, competitive world?

- How do we offer our customers a seamless, easy banking experience?

If those weren't challenging enough, the same executives are also tasked with changing regulations, evolving technology, new payment methodologies, and non-traditional competitors entering their space.

But while the internal focus is important, it has never been more important to review business through the lens of customer experience.

As we look inside and outside the banking sector, it's clear that businesses focused on customer experience are winning. Consider such success stories as Umpqua Bank, USAA, and SunTrust Bank, as well as other customer experience household names like Amazon, Zappos, the Ritz Carlton, and Disney. Not only will the customer-centric survive, but also thrive.

A Customer-Centric Roadmap to Success

In helping our banking clients develop a clear roadmap to excellence in customer experience—and ultimately, growth—PeopleMetrics has uncovered the customer-centric disciplines that differentiate strong financial performance from weak.

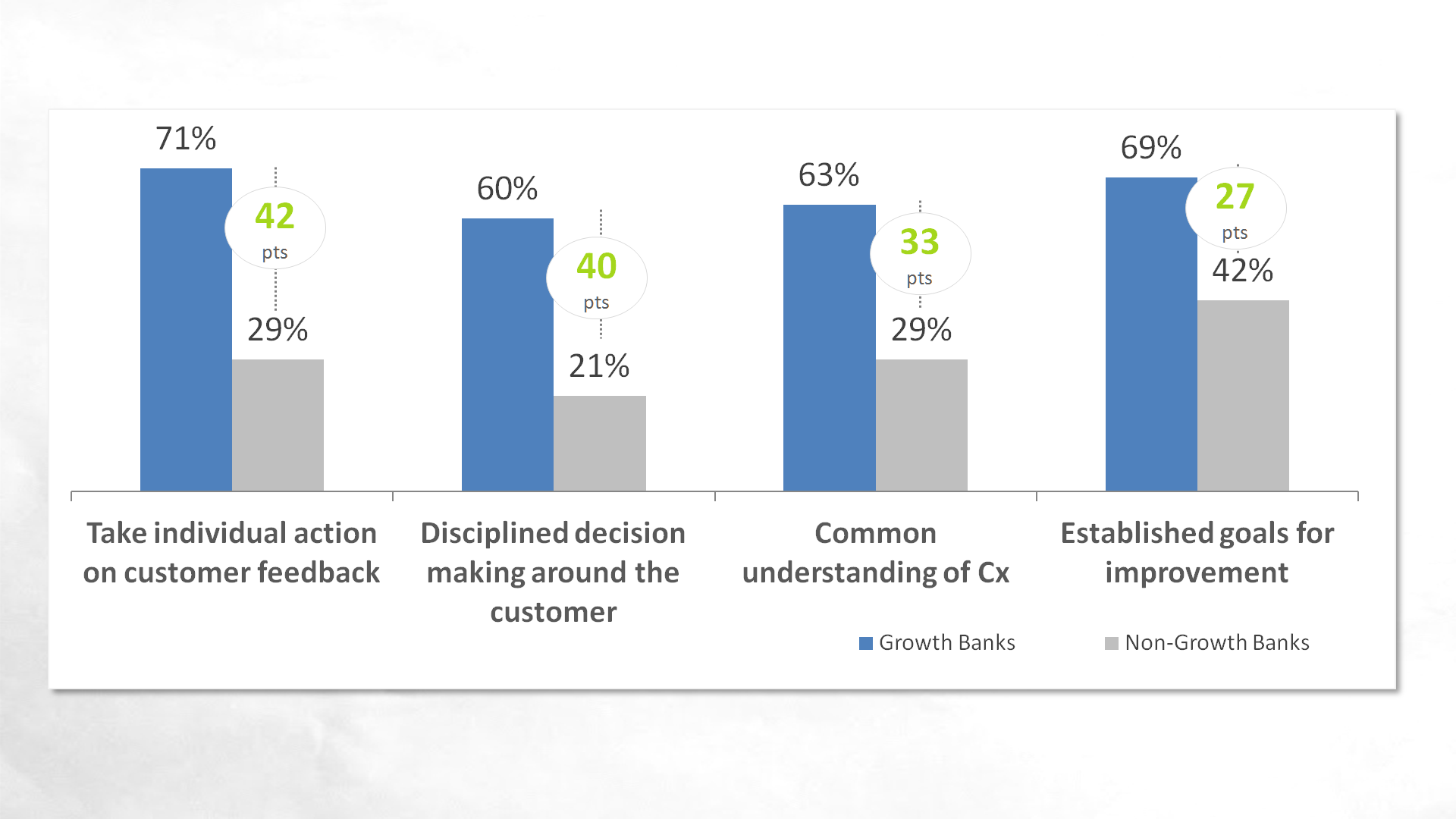

Comparing feedback from bank executives working for growth banks to those in non-growth banks (which have either stagnating or declining revenues), we found that the growth banks practice four disciplines more than non-growth banks do:

- Finding and communicating a common definition of who their customers are and what their customer experience is (and is not);

- Committing to a decision-making process that includes the customer;

- Establishing clear goals for customer experience improvement overall and for every role/department; and

- Listening to and taking action on individual customer feedback.

These four disciplines are the basis for this learning course. We'll cover each of the disciplines in detail, to help you understand how they can help your bank.

The Biggest Gap

Here is a snapshot from our study into the banking industry. It shows the adoption rate of the four disciplines between growth and non-growth banks.

The one discipline with the biggest gap between growth and non-growth banks is "[Taking] individual action on customer feedback." In other words, growth banks are more often using closed-loop customer feedback management systems, which allow them to listen and respond to customer feedback. Such systems enable them to strengthen and expand customer relationships on a daily basis.

Customer feedback management creates a habit of listening and responding to customers, which leads to a continuously improved customer experience.

The Take-Home

For banks just getting started on the customer experience transformation journey, the four disciplines listed above offer a snapshot of where to focus your efforts for the biggest impact. But if you're a go-getter after customer-centric growth, then check out this free, downloadable resource. It lists the ten customer-centric disciplines exhibited by growth banks (beyond those with the biggest differences in adoption).